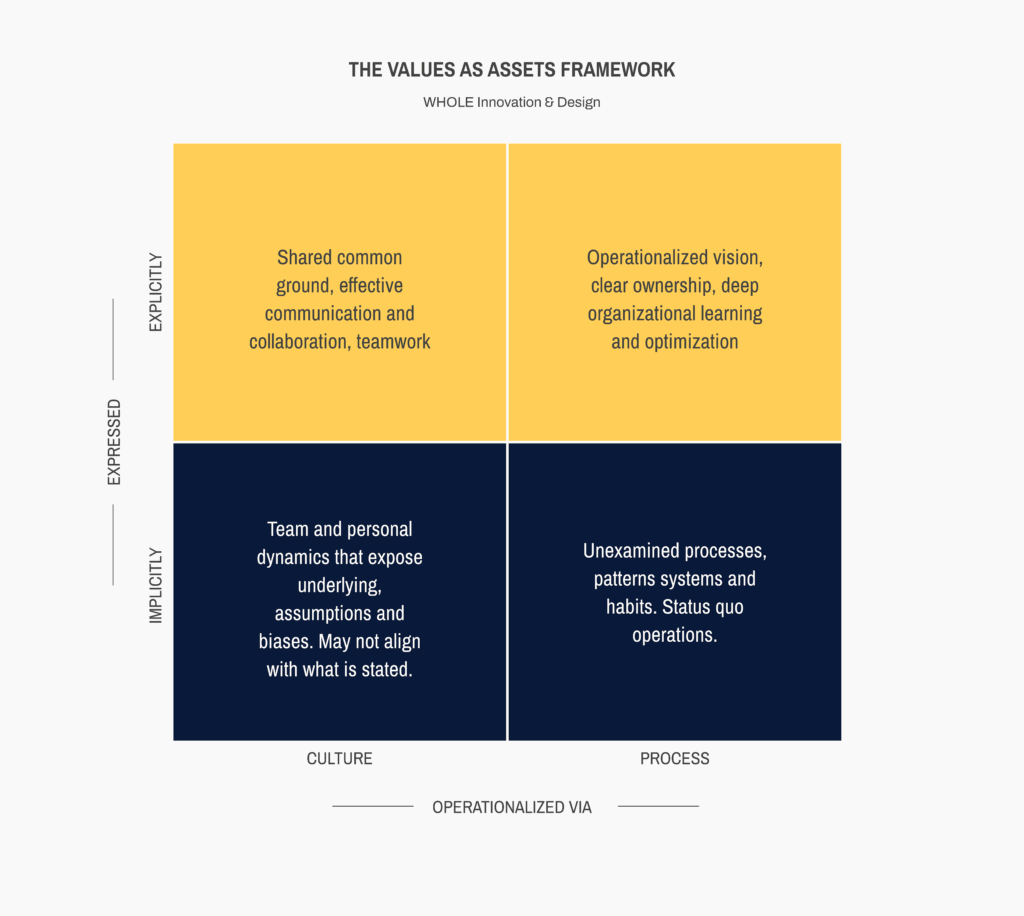

Values are more than a nice story to tell. They are guides that can be as tangible and effective as other goals and indicators commonly leveraged in business. In fact, when we put the rigor into operationalizing our values as we do our other goals, they become strategic assets. The WHOLE Values Framework offers a simple way of understanding of the different ways we operationalize our values so that we can become more effective.

CORE TENETS

- Values are operationalized implicitly and explicitly.

- When done implicitly, an organization is unable to learn from values and manage based on those learnings.

- When operationalized explicitly, organizations are able to leverage values as a tool for innovation and competitive advantage.

HOW ARE THEY OPERATIONALIZED?

To keep things simple, we see two main avenues through which values are operationalized.

- Cultural

- This is all about the culture of your organization down to the teams and disciplines levels.

- Procedural

- The way your organization or team has formalized your ways of working. Each way of working, each process is designed based on a decision informed by something.

CULTURAL

Some ways values can show up in cultural elements include, but are definitely not limited to:

- Narrative – Mission statements, marketing, storytelling

- Experiential – Events, rituals and ceremonies, social dynamics

PROCEDURAL

Some of the ways values get formalized into process are:

- Prescriptive – Strategy, planning, forecasting

- Retrospective – Assessments, KPIs, etc.

At the end of the day, values inform your assumptions, goals and outcomes. If they have such an outsized impact on your organization, the most strategic thing you can do is make them explicit. This can be done at the team, departmental and organizational levels, via workshop or asynchronously developed insights.